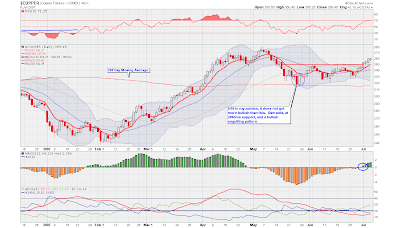

Once you gain a basic understanding of candles, and the pyschology behind them, it becomes clear that some individual candle lines are extremely bullish. The problem is that if you are just looking at your favourite stock, special candle formations may come about only once in a blue moon.

This problem can be aleviated through using stock scans. The website, www.stockcharts.com, which is where all my charts originate from, also has a very powerful stock scanner. In this post, I will show you how we can scan through thousands of stocks and pick out a couple that meet our criteria.

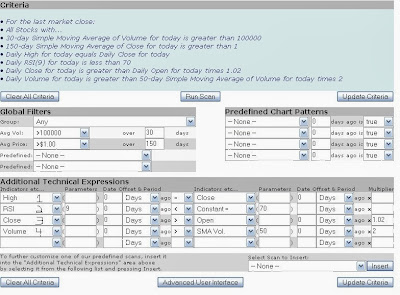

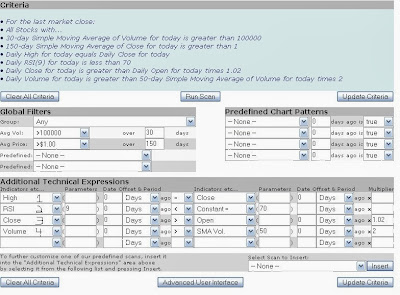

This post will involve a scan that is very simple, but also highly potent. I have taken a screen shot of StockCharts stock scanning setup:

What we are trying to do is find a stock in North America that, for the day, experienced a large increase, with heavy volume, and closed on the high of the day. This candle would be tall, white, and have shaved head. In my opinion, this is an extremely bullish combination.

So, if you look at the above image, at what I have marked off as line 1, what this says is that the high zero days ago (today) is equal to the close today. This is the shaved head part of the equation.

Line 2, just says that we do not want stocks that are overbought. We want stocks that have a 9 period RSI of less than 70.

Line 3 says that we want the close to be greater than the open for today. All this means is that the stock needs to have risen today. And it needs to this by a factor of 1.02, which means that the stock must have risen by 2% or more on this day.

Finally, line 4 says that we want the stock's volume for today to be twice as much as the 50 day moving average of volume. Basically, we want heavy volume for this day.

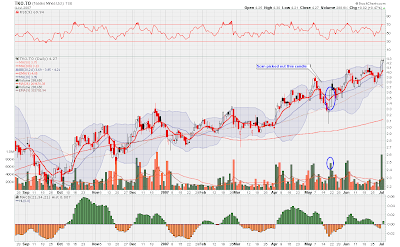

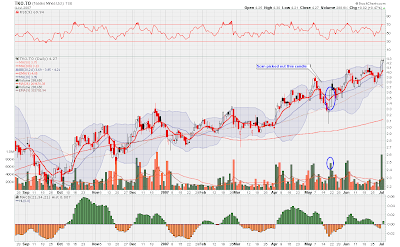

When I ran this scan a couple weeks ago, it picked out the following stock, and I'll show a chart of it now.

I have drawn a circle around the candle the scan isolated. As you can see, it was indeed tall, it closed at the high of the day, and the volume was heavy. This meant that the bulls were clearly in control on this day and that higher prices would likely follow. Another aspect of the chart that I like, and the scan had nothing to do with this, is that the stock is in an uptrend. That is worth a lot of points in my books.

Although this scan does not really have anything to do with gold stocks, I think it is important hold some stocks that are not gold related. This scan has helped me add stocks to my brokerage account that are not correlated to my gold stocks holdings, so it helps reduce some risk. Anyway this post was quite long and went through a lot of information, and I hope it made sense. If not, send me an email.